It’s a few years now since Brexit, and yet as a logistics company we still spend a considerable amount of time dealing with incorrect Invoicing. To be clear, it’s not the fault of our customers, suppliers, customs agents or hauliers. Ever since Brexit, each of these parties has been playing catch-up with often conflicting information when shipping their goods.

So, I hope this brief overview will help you to avoid most of the common mistakes when creating invoices for shipments to/from the EU.

Download our sample Invoice. Click the correct tab for the relevant area you are trading with (EU etc). Update and use as required.

Invoice format, name and Number

Invoices should be named “Commercial Invoice” or” Shipping Invoice”. Proforma invoices or other named invoices are often rejected. All invoices should have an Invoice number. All invoices should be produced on company letterhead. Each invoice should be Dated, Signed and have Name and Position printed. Each page should be numbered. Handwritten invoices are not allowed.

Incoterm

The correct full incoterm should be shown on the invoice. I wouldn’t normally point you to Wikipedia, but this page is generally a good guide to work off.

The only exception to the incoterms used is with the term DAP on Road freight to/from UK/EU. To determine which company is responsible for paying for the destination customs entry the industry generally used DAP Uncleared or DAP Cleared to decide. In both cases the Importer of Record remains the Consignee or other destination party.

Invoice parties to be shown

Parties to be shown on the Invoices should be at least.

- Shipper

- Sender (Collection point)

- Consignee

- Receiver (Delivery point)

Note that for customs to know who is responsible for the customs in UK and/or EU then it is advisable to show “Exporter of Record” and “Importer of Record” next to the relevant parties. These are the companies that will be shown on the customs entries and will be responsible for any VAT and Duties. In many cases they will also need to complete a “Power of Attorney” for the local customs agent. In many cases parties may have multiple roles such as Shipper, Sender and Exporter of Record (or) Consignee, Receiver and Importer of Record.

All parties should show at least

- Company name

- Full address (including building, street, town/city, postcode and country)

- EORI number (some countries also require VAT number)

And for good practice

- Contact person

- Phone number

Description of Goods

Generic names of goods are not allowed, such as Car spares or Electrical items and instead specific detailed descriptive names should be used. However, it is important that the description/name should also be understood by a person outside of the specific field.

Items

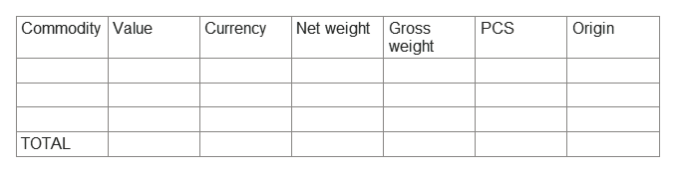

Items should be shown separately, each as a line on the invoice broken down by at least Commodity Code and Country of origin. Each item should show

- Quantity

- Description

- Commodity code

- Country of origin

- Net weight

- Gross weight (or prorate)

- Unit price

- Totalled line price

In cases where the origin is a EU country then please show the country and not “EU”. For EU countries of origin, a REX number should be shown. Customers should hold records of Country of Origin from manufacturers in case customs authorities request proof. In the absence of proof or a UK/EU declaration then the shipment is likely to be relegated to 3rd country status meaning Duty may be payable.

In cases where multiple items are shown then it is advisable to add an additional Customs Breakdown of tariff items such as below.

UK/EU declaration

All invoices where part or all the items are of UK or EU origin, should show a UK/EU declaration worded as below.

(Period: from 01/01/2025 to 31/12/2025 (1)) The exporter of the products covered by this document (EORI / Exporter Reference No …………………….. (2)) declares that, except where otherwise clearly indicated, these products are of UK/EU (3) preferential origin.

- Please amend to show the year of shipment

- Please amend to show the shippers EORI number

- Please amend to show UK, or EU or UK+EU

Package details

Outer Package details should be shown on the invoice including

- Outer package (Pallets, Cases, Crates, Boxes etc.)

- Quantity

- Dimensions (suggested in cms as Length x Width x Height)

Supplying the Invoice

Due to all the problems with customs since Brexit, customs agents, hauliers and other carriers are starting to request Invoices at the time of booking to ensure all customs are correct and in place prior to shipment and try to avoid delays.

NB. whilst invoices are briefly checked, the responsibility to complete the Invoice and any liabilities remain with the Shipper or customer. For more information consult the type of representation provided by the customs agent (Direct or Indirect). The above is only provided as a brief and unofficial outline. For full guidance please visit great.gov.uk